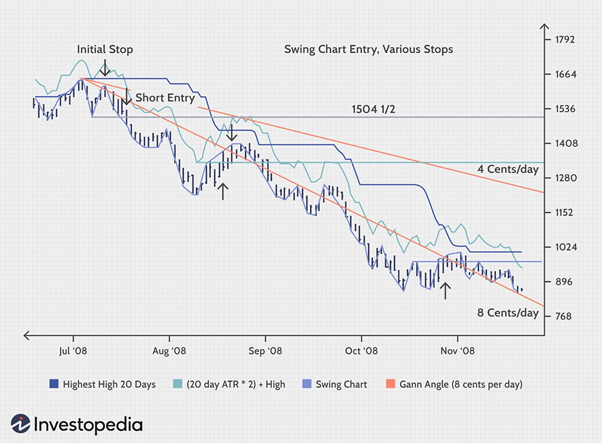

A trailing stop order is an indicator that can be set to move a percentage of the profit or loss away from a trade when a stock moves in a specific direction. A typical regular stop-sell order would stay at $125, but it might not move up to $160 if price were to move in that direction. This means that you would need to manually adjust the Stop-Sell order in order to maximize your gains and minimize your losses. Trailing stop orders can help automate this process and can be used as an aid in a trading strategy.

Trailing stop orders remain in effect until they are triggered. Unlike Stop Loss, trailing stops are attached to open positions, not to a server. Unlike a stop order, a trailing stop is set using the “Terminal” window of an open position. To use a trailing stop, select a stock’s current price and then enter the amount you want the price to fall to. You can only set one trailing stop per open position.

Ideally, a trailing stop should not fall below the current price. A stock that experiences 5% or 8% pullbacks will fall below 3%, which makes a 20% trailing stop an inappropriate level. You can also use absolute price movement, which remains constant even as the position price decreases. In this case, a $5 trailing stop would trigger at $115 (a 4.2 percent fall) and a 5 percent trailing stop would trigger at $114. In this way, you would have maximum flexibility and don’t have to manually adjust the stop.

In order to use a trailing stop order, you should select a limit price. It is important to note that a limit order is not always filled, as it can gap past a stop price. For example, if the market is volatile, a limit order can cause the trailing stop to miss its target. You should be careful to use a limit order only when you are sure you will make a good investment decision.

A trailing stop loss order is a free risk management tool that only moves when the market moves in your favour. This way, you’re protected against losses and lock in potential profits. A trailing stop loss order is usually set to a price or a percentage of the market price, and can be as specific as the amount you’re willing to risk in a trade. By following the market, you can lock in your upside and limit your downside risk.

Trailing stops are another type of stop-loss order. They move in the direction of the price. If the stock price moves upward, the trailing stop remains at the stop loss price. This way, your position will continue to move in a positive direction, but you’ll be locked out of losing any profits. Alternatively, if a stock moves in the opposite direction, the trailing stop will cause the trade to stop.